According to the World Economic Forum, 25% of a company’s market value comes from its reputation. Loss of a firm’s reputation can impede market capitalization or prompt shareholders to sell off their stake.

Monitoring and maintaining this reputation is therefore paramount to business success and Reputational Risk Management has consequently emerged as a sector for safeguarding companies' brand sentiment and very livelihoods.

Monitoring the Banking Elite

As a case study, we performed adverse media tracking on the top 20 financial executives in the world over the last 8 months.

Using our News API, we searched for any mention of the names on our watchlist as well as any reference to non-financial risk-related topics such as corruption, investigation, bribery or money laundering - the typical scandals that occur in the finance industry.

We can see at a glance that there are major spikes of story volumes. With the benefit of hindsight we know that most of these spikes are associated with the Credit Suisse scandal. When former employee Iqbal Khan resigned, the company COO Pierre-Olivier Bouée hired private investigators to ensure he was not enticing Credit Suisse customers elsewhere.

The revelation of the surveillance forced Bouée's resignation and the fallout - which included the suicide of another staff member who personally hired the private investigators - led to the admission of further instances of spying and culminated in the resignation of CEO Tidjane Thiam - a member of our watchlist.

Hover over the markers to see contextual information for the spikes in media.

We also see a spike on February 13, which would appear to be the result of a story breaking relating to the investigation of links between Barclays CEO Jes Staley and disgraced financier and sex offender Jeffrey Epstein. The Bank of England launched an inquiry after emails between the two men were handed to the UK regulators by their counterparts in the US.

If we didn't know what these spikes in media volume related to, our first question might be: is this good media attention, or bad media attention? If we split these stories by sentiment (and ignore neutral stories), we can see that the media reaction is overwhelmingly negative during these spikes. Learn more about sentiment analysis here.

Hover over the markers to see contextual information for the spikes in media.

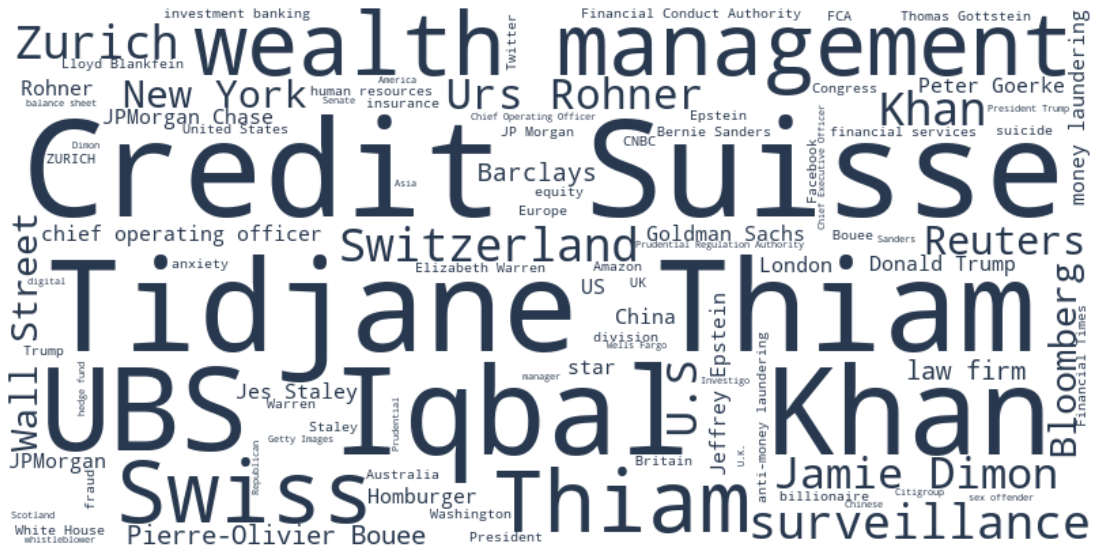

Entities - who or what is mentioned in these news stories?

Using our trend analysis capabilities, we can find the most frequent entities, concepts or keywords associated with these stories. We pulled this data for the stories represented in the graphs above and visualized them in a word cloud.

Again, imagining that we are unaware of the unfolding scandals mentioned above, we would immediately be prompted to investigate why Credit Suisse, Tidjane Thiam and Iqbal Khan dominate the visualization.

However, most worryingly the presence of words or concepts like “surveillance” and “suicide” featured in our analysis. UBS also features prominently, which is somewhat expected given Khan switched his allegiances to the bank, but also because UBS has announced that they were searching for a new CEO.

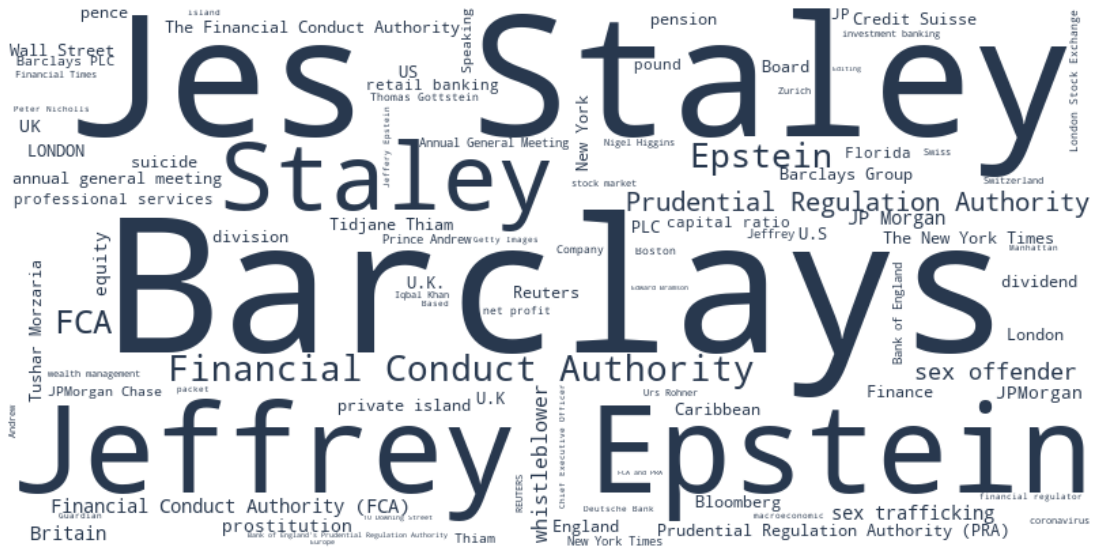

If we perform a similar entity investigation for the spike of media volume on Feburary 13 only, we can indeed confirm that this is as a result of media focus on Jes Staley’s links to Jeffrey Epstein.

Clustering – what were the major stories?

Another approach we could take to adverse event detection is to use our clustering capabilities. This feature groups articles that cover the same events, allowing us to deduplicate and cluster stories for ease of reference and quantifying the significance of an event in the media.

Below, we can see the story clusters relating to Credit Suisse, Tidjane Thiam and Iqbal Khan. We can see the various clusters concerning Credit Suisse over time, from initial articles concerning Iqbal Khan alleging he was being spied upon, to Thiam’s eventual resignation.

Hover over each cluster to see contextual information.

Know Your News, Know Your Exposure

While the Credit Suisse scandal has impacted the bank with the loss of two high ranking executives – not to mention the death of another staff member – it has undoubtedly damaged the corporation in a more intangible manner through reputational risk and brand sentiment.

Elsewhere, the repercussions of the Staley-Epstein investigations are yet to be unveiled at Barclays.

Related Content

-

General

General16 Feb, 2024

Why AI-powered news data is a crucial component for GRC platforms

Ross Hamer

4 Min Read

-

General

General24 Oct, 2023

Introducing Quantexa News Intelligence

Ross Hamer

5 Min Read

-

Product

Product15 Mar, 2023

Introducing an even better Quantexa News Intelligence app experience

Ross Hamer

4 Min Read

Stay Informed

From time to time, we would like to contact you about our products and services via email.